Get the free Payrolls by Paychex, Inc

Show details

Payrolls by Patches, Inc.550 15TH ST STE 29 SAN FRANCISCO CA 94103DDNONNEGOTIABLECELINE MASSEUR 21638 PREVIEW COURT WALNUT CA 91789Payrolls by Patches, Inc. A8403146 ORG1:100 G & A EE ID: 71MOTIONLOFTNONNEGOTIABLEPERSONAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payrolls by paychex inc

Edit your payrolls by paychex inc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payrolls by paychex inc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payrolls by paychex inc online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payrolls by paychex inc. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payrolls by paychex inc

How to fill out payrolls by Paychex Inc?

01

Visit the Paychex Inc website or login to your Paychex Inc account.

02

Access the payroll section on the website or within your account.

03

Enter the required information for each employee, such as their name, social security number, and employment details.

04

Input the hours worked and any other relevant information for each employee.

05

Calculate any deductions or withholdings, such as taxes or benefits.

06

Verify the accuracy of the payroll information entered.

07

Submit the completed payroll information to Paychex Inc for processing.

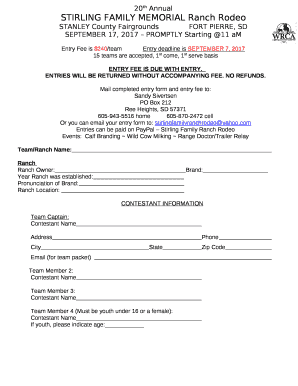

Who needs payrolls by Paychex Inc?

01

Businesses of all sizes can benefit from using Paychex Inc's payroll services.

02

Small businesses that do not have a dedicated HR or payroll department can utilize Paychex Inc to ensure accurate and timely payroll processing.

03

Medium to large businesses that require comprehensive payroll management solutions can rely on Paychex Inc's services to handle all aspects of payroll processing.

04

Self-employed individuals or freelancers who want to streamline their payroll process can also use Paychex Inc to simplify their financial operations.

Note: Paychex Inc provides payroll services to a wide range of businesses and individuals, making it a versatile solution for various payroll needs.

Fill

form

: Try Risk Free

People Also Ask about

Does Paychex have direct deposit?

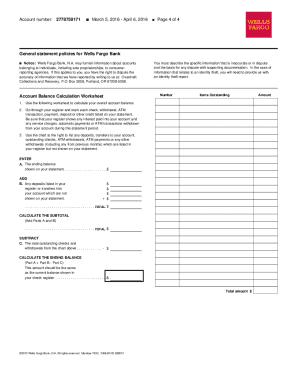

Direct Deposit Form Enroll in direct deposit or make changes such as removing bank accounts, adjusting the amounts deposited between them and a payroll debit card, and more.

Does Paychex file form 941?

The Illinois Department of Revenue requires all employers, including bulk service providers, to electronically file Form IL-941, Illinois Withholding Income Tax Return. Taxpay You aren't required to take any action. Paychex will file your returns.

What is Paychex direct deposit form?

The Paychex direct deposit form must be filled out and signed by an employee wishing to set up a direct deposit transfer as a method of compensation with their employer. This form should then be submitted by the employer to the Paychex office where they hold a payroll account.

How do I get my 941 from Paychex Flex?

Log in to Paychex Flex. From the Dashboard, select Tax Documents. Click the PDF icon to View All. Click the name of the tax document you want to see.

How do I fill out a direct deposit for Paychex?

Add a Direct Deposit Click employee | Personal Information | Direct Deposit. Click Add a Direct Deposit. Select the Percent of net pay, Fixed dollar amount, or Remainder of net pay in the Deposit Amount ($ or %): drop-down menu, then type the amount in the Deposit Amount ($ or %): field.

What is payrolls by Paychex Inc?

Paychex Flex makes payroll processing and paying employees simple from your desktop or our mobile app with pay options including direct deposit, paycards1, paper checks with check signing and insertion, Pay-on-Demand (prior to payroll date) and 24/7 Real Time Payments1.

How do I fill out a Paychex form?

0:03 2:47 Complete Paychex Direct Deposit Form - YouTube YouTube Start of suggested clip End of suggested clip So at the very top you're going your first middle initial or name. And your last. Name right belowMoreSo at the very top you're going your first middle initial or name. And your last. Name right below it you're going to enter the last four digits of your social security. Number.

What is Paychex payroll?

What Is Paychex? Paychex is a human-capital services company that handles payroll, employee benefits, and other human resources functions as well as business insurance for small and medium-sized businesses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out payrolls by paychex inc?

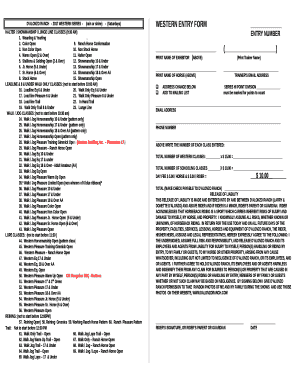

1. Gather the information necessary for each employee. This includes the employee's name, address, Social Security number, and job classification.

2. Enter the employee information into the Paychex payroll system.

3. Calculate the employee's wages, including regular pay, overtime pay, bonuses, and deductions.

4. Print out the payroll and have the employee sign it.

5. Make sure all employees are paid according to the pay period schedule.

6. Submit the payroll to the appropriate government agencies, such as the IRS, state tax agency, and local tax agency.

7. Pay the employee according to the payroll.

8. Reconcile the payroll and submit a statement of payroll taxes and deductions to the appropriate government agencies.

9. Keep accurate and up-to-date records of all payroll activities.

What is payrolls by paychex inc?

Payrolls by Paychex Inc. is a comprehensive payroll processing service offered by Paychex, a leading provider of human resource solutions for small and medium-sized businesses. Payrolls by Paychex Inc. helps businesses manage their payroll processes efficiently, accurately, and in compliance with applicable laws and regulations.

This service includes handling tasks such as calculating employee wages, withholding appropriate taxes, managing direct deposits, generating pay stubs, and filing payroll tax forms. Paychex Inc. utilizes advanced technology and tools to streamline the payroll process and ensure accuracy.

By outsourcing payroll to Paychex Inc., businesses can save time, reduce administrative burden, and minimize the risk of errors or non-compliance. Paychex Inc. also offers additional services like handling employee benefits, retirement plans, and providing comprehensive HR solutions, making it a one-stop-shop for small businesses' HR needs.

Who is required to file payrolls by paychex inc?

As a provider of payroll processing and HR services, Paychex Inc primarily works with employers who need assistance with managing their payroll. Therefore, it is the employers who are required to file payrolls using Paychex's services. The employers provide the necessary employee information and payroll data to Paychex, who then processes the payroll and ensures that the required tax filings and payments are made to the appropriate authorities.

What is the purpose of payrolls by paychex inc?

The purpose of payroll services provided by Paychex Inc. is to assist businesses with the management and processing of employee wages, salaries, and other compensation. Payroll services offered by Paychex Inc. include calculating gross wages, withholding the appropriate taxes, issuing paychecks or direct deposits, maintaining employee records, and filing payroll taxes and reports. By outsourcing payroll services to Paychex Inc., businesses can streamline their payroll processes, ensure compliance with tax regulations, save time, reduce errors, and focus on their core operations.

What information must be reported on payrolls by paychex inc?

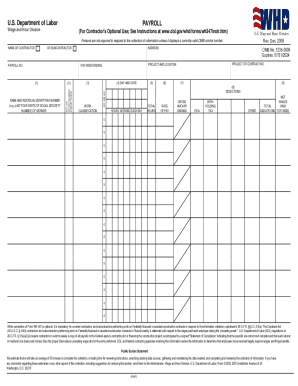

Paychex Inc. is a payroll and human resources services company, and the specific information that needs to be reported on payrolls can vary depending on the country, state, and local laws, as well as the requirements of each individual employer. However, here are some common elements that are typically included in payroll reporting:

1. Employee Information: Details such as employee name, address, social security number, employee identification number, start date, and other identifying information.

2. Pay Period: The specific dates for which the payroll is being processed, such as weekly, bi-weekly, semi-monthly, or monthly.

3. Hours Worked: The number of hours worked by each employee during the pay period, including regular hours, overtime hours, and any other types of leave or absences.

4. Earnings: The gross amount earned by each employee during the pay period, including regular wages, overtime pay, bonuses, commissions, tips, and any other forms of compensation.

5. Deductions: Any authorized deductions from the employee's gross earnings, including taxes, social security contributions, healthcare premiums, retirement contributions, and any other approved deductions. This may also include voluntary deductions, such as contributions to a 401(k) plan or flexible spending account.

6. Net Pay: The final amount that the employee will receive after all deductions are subtracted from the gross earnings.

7. Employer Contributions: Any contributions made by the employer on behalf of the employee, such as employer-paid taxes, contributions to retirement plans, or other benefit programs.

8. Tax Withholding: The amount of federal, state, and local taxes withheld from the employee's paycheck, based on their tax information, filing status, and any deductions or exemptions claimed.

9. Year-to-Date (YTD) Information: The cumulative totals of earnings, deductions, and tax withholding for the year-to-date, which may be necessary for tax reporting and reconciling payroll data.

10. Employer Information: The company's name, address, employer identification number (EIN), and other information required for tax reporting purposes.

It's important to note that this information is not an exhaustive list, and additional data may be required based on specific regulations or employer-specific policies. Additionally, reporting requirements can vary across different jurisdictions and may be subject to change, so it's crucial for employers to stay informed about applicable laws and regulations and ensure compliance with payroll reporting requirements.

How do I make changes in payrolls by paychex inc?

The editing procedure is simple with pdfFiller. Open your payrolls by paychex inc in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I edit payrolls by paychex inc on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing payrolls by paychex inc.

How do I fill out payrolls by paychex inc using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign payrolls by paychex inc and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your payrolls by paychex inc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payrolls By Paychex Inc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.